TL;DR There is stuff to do. Just a smidge of attention to place on something the blabber heads aren't paying any attention to...Most people have seen Top Gun and in a dog fight the chased pilot fires off flares to act as decoys to distract missiles.

In submarine warfare you have the same thing, but because everything is much slower we could be more fancy. We could make our decoys float and move to mimic other ships/submarines but of course be “noisier” than us and hence present a better target to the chasing torpedo.

Whether they know it or not (the ones that do know are very dangerous) most financial commentators are noise makers and distractions.

One such particular piece of noise is “the everything bubble”, does this look like an everything bubble to you?

From its peak on 4th Dec 2024 to 4th December 2025 it is down 84% to today 88%.

“What the hell is Sandbox? Chris”

I have no idea I just clicked of one in a hundred that look just like it.

Excuse my language but that is a pretty shitty bubble.

Using the same period Oil is -17%.

Gold is +63%.

Just for a second remove the SP500 and Nvidia and QQQ from the equation. If you had only the two charts above what would you surmise about markets and the economy?

Do you think your answer would be it looks more like the end of 2020 or the end of 2021?

By the end of 2020 many of the noise makers were talking about how things had moved “too far too fast” and that we would have to feel the pain of our decisions.

2021 saw the noise makers talking about “In essence, the financial media consensus at the end of 2021 was one of cautiously optimistic growth and stocks, tempered by inflation concerns and tightening monetary policy, rather than an expectation of an imminent downturn.” I am not sure if ChatGPT makes my point or not with this summation but I am not going to cherry pick something just for the three people that are still reading all the way down here…

Torpedos are designed with jammer tactics and decoy classification. They will break off the attack turn and dive to preset depths run away from both the target and the decoy fire 2 active pulses of sonar and try to regain the target.

That is our job!

My choice is not to listen. I don’t have to I am not in the financial industry, I do not have clients swimming in financial bullshit and have questions to answer no matter how non-sensical.

So most people need to deploy jammer tactics, consume just enough to inform your own opinion but not too much that you become locked onto the decoy.

“What does this have to do with Crypto bro?”

Just like when we bought Health Care stocks 44% returns ago, crypto is hated! Michael Saylor cannot even buy a slot on CNBC or Bloomberg.

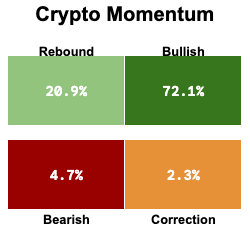

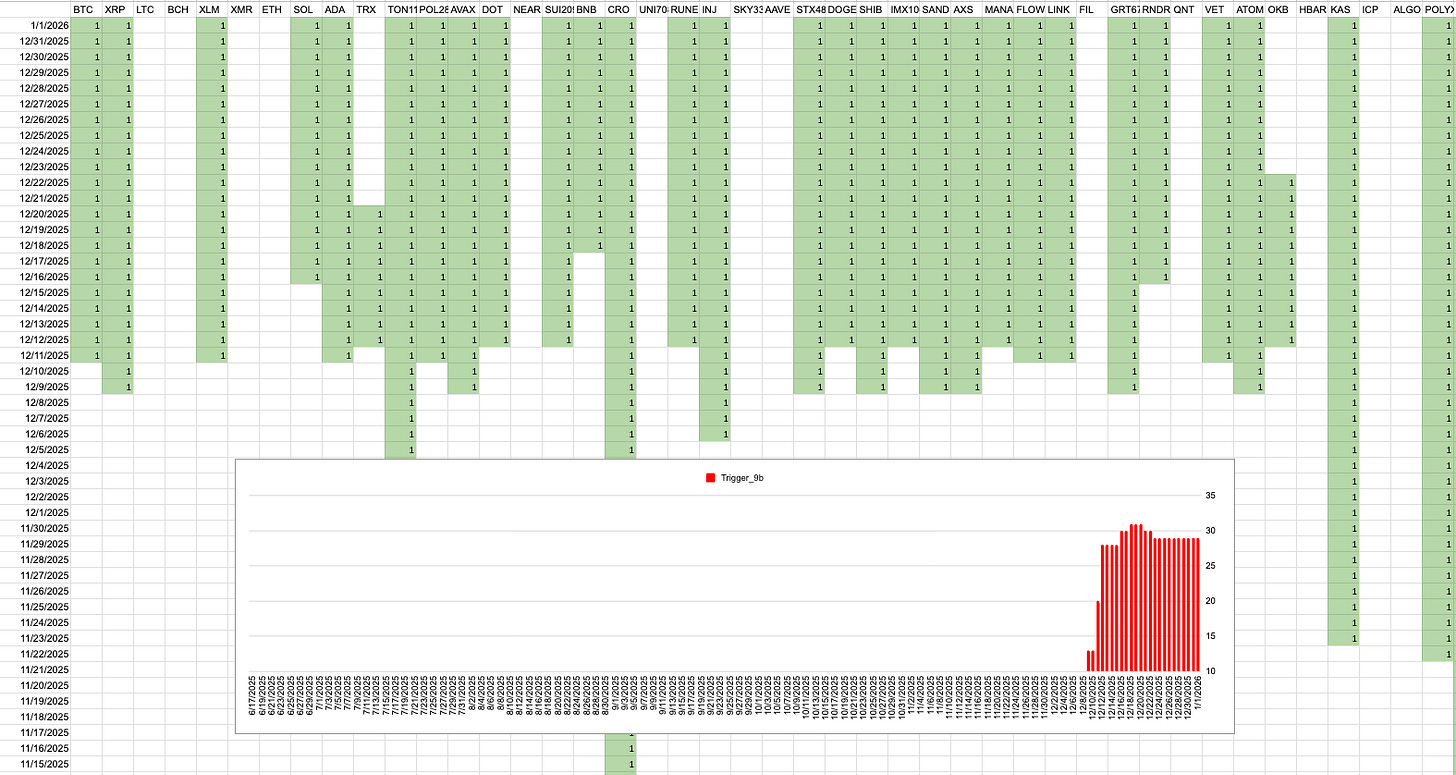

Trigger_9b is the scraping the barrel you may as well not exist kind of trigger.

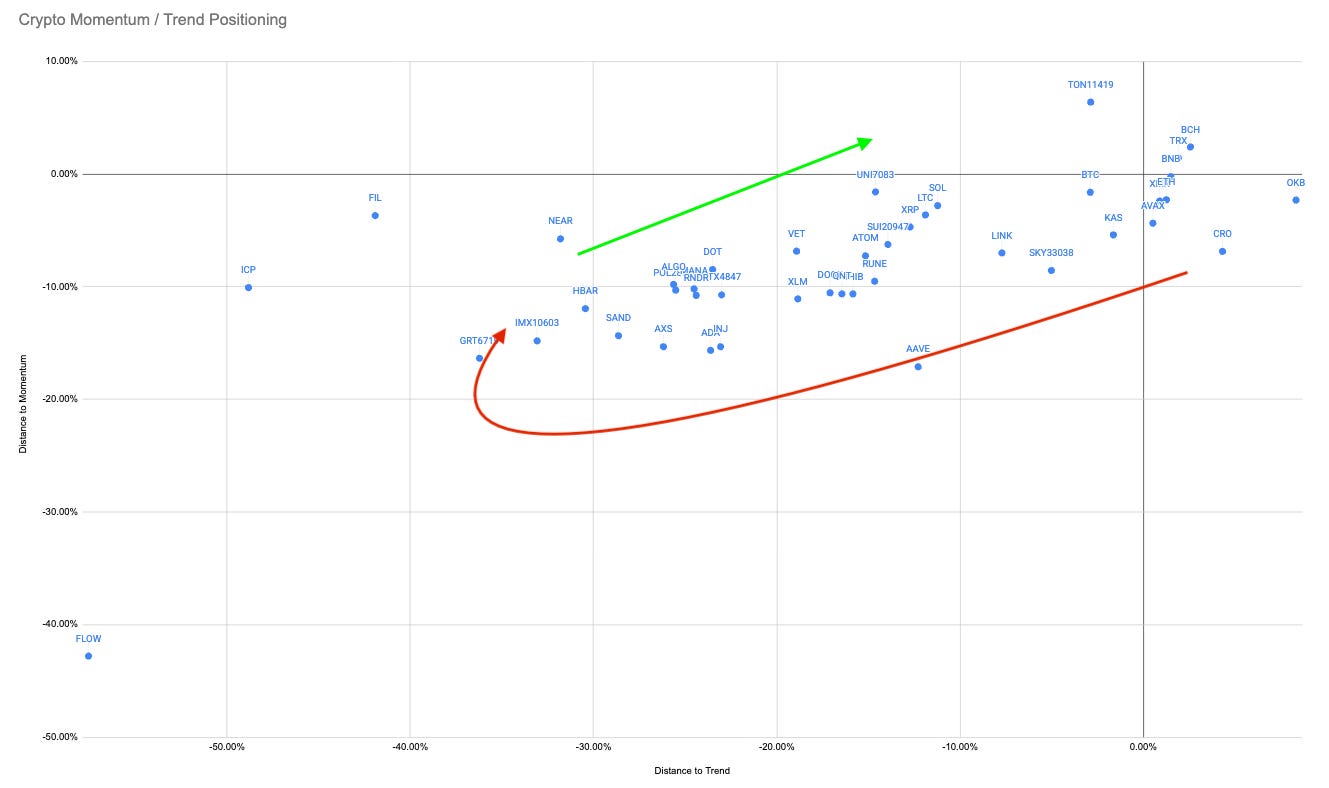

These things are never perfect at least as I view things the anti-bubble in crypto could be ending. Now that does not mean remortgage the house and go full naked long some penny shitcoin.

It means whatever you have decided is your number for your portfolio 1-5-10-20% whatever it is now while none of the noise makers are in the water is the time to be looking at the space.

If you have done your research and picked some coins that you “believe in” well perhaps now is the time to buy 1% of your 10% allocation and watch it like a hawk.

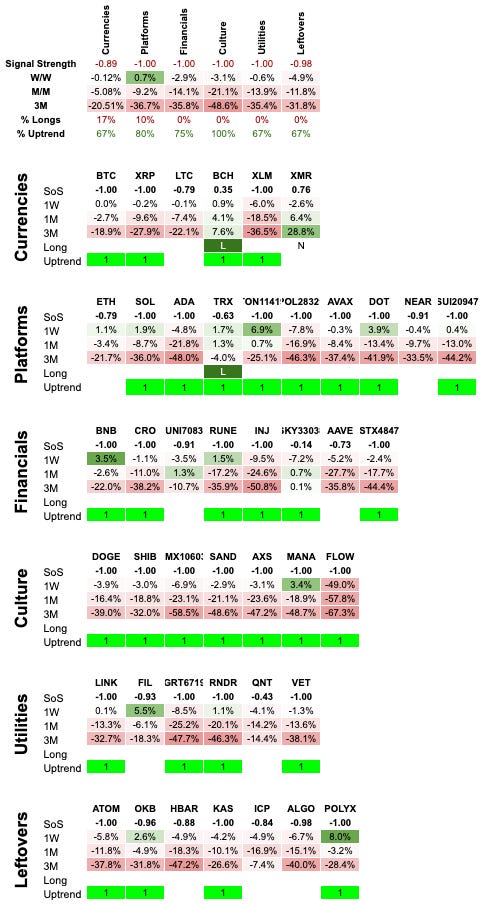

1 XMR ↗︎

2 SKY ↘︎

3 BCH -

4 UNI ↗︎

5 TRX ↘︎

6

7

8

9

10

11

12

13

14

15 Let me be honest the turn could well be coming simply because the numbers that drive everything cannot get any worse.

This should be the answer to most things. Not some bullshit story that is never checked after the fact.

Someone can write a piece and get millions of views and all we really know is that he used his degree in English Literature to write wonderfully.

What we never consider is if he had posted that “prescient piece” 6 months earlier or 6 months after would it have been so fortunate?

Who knows?

If you want to play in crypto now may be the time where you can dip your toe with at least some cover for the largest losses.

That doesn’t mean that these things get a free pass because they are “cheap”!

Everything has to prove its place in your portfolio. Each ticker/token/coin needs to meet our long criteria and maintain its uptrend.

With so many noise makers and decoys in the water I just look at the numbers. I cannot tell you about all the implications of China weaponising gold to break the USDollar like some of the greatest Macro Thinkers on Twitter with their Sociology Degrees. I cannot compete in that intellectual arena.

So all I have is what I share with my wiggly lines.

I know at the start of this I asked you to remove the SP500 from your analysis of what the macro might be telling us but seeing the SPX and the VIX are probably the single biggest factor on global markets lets bring them back in..

I think the more likely outcome is a compression of volatility. As April 2025 becomes an ever smaller part of the look back window it will force a compression of what we use here which are trend lines/bands.

“What does that have to do with crypto?”

I think it has to do with everything it means that models will be forced to increase total risk. Each unit of risk will now account for a smaller proportion of the portfolio because its volatility will be smaller.

I am in the “2021 is ahead of us” group. I think the silliness can get a lot sillier.

Importantly if I am wrong I have wiggly lines to tell me I am wrong and I can close my positions. I do not have to rent conviction from some talking head about what an asset will do and just have wait for another YouTube video for them to tell me everything will be OK don’t sell yet.

Rant over.

I wish everyone a great 2026 and I hope you are happy and lucky.