Energy Leadership: Does It Have Enough Gas to Warm Up the Index?

Week 13 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

We had a brief blip above, then right back to red.

Daily timeframe:

Hanging out below trend. It spends ~10% of trading days down here.

ST and LT momentum are still falling.

Others:

Big moves are the name of the game.

All strength of signal measures are still falling.

Have you ever had a croissant for dinner?

Does this type of analysis only work when we have positive momentum anyway?

Do croissants only work for breakfast, and OpEx signals only work when the market is trending?

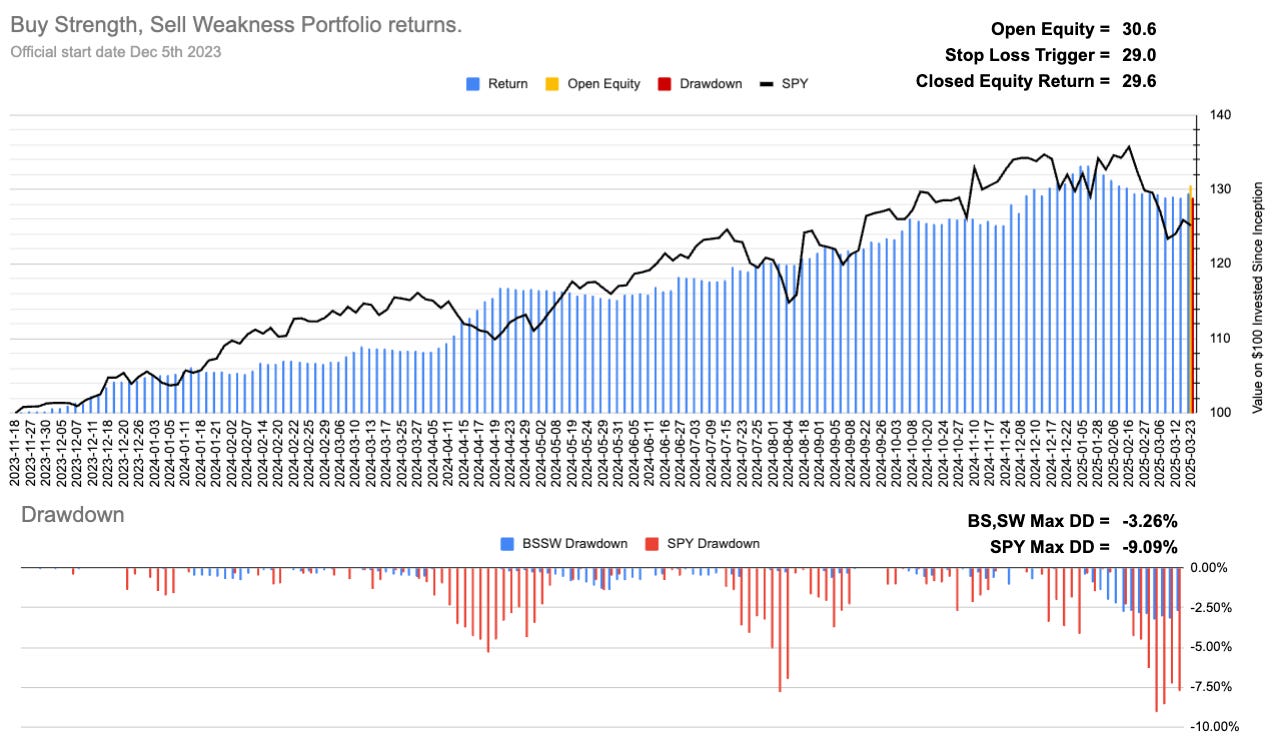

Current Open Equity = 30.6%

Stop Loss Trigger = 29%

Current Closed Equity Return = 29.6%

Our open equity outstanding is ~31% since we started in Dec ‘23. We have been able to capture ~29% returns in closed trades, meaning ~2% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit bar any gap risk we hope to close ~29%

It cannot always be rosy! There is no free lunch we have to risk losing to be in the game to win. We could have a -0.6% reduction on closed equity.

People can use this link to access a 30day extended trial!!

https://www.thousandairespx.com/extratrial

You can thank Mr Bloodbringer for this extended trial.

If I could ban him from using it I would as he is the very worst of whiners. He appears to be a non-lambo bitcoin bro and he works for BlackRock!! Bitching about $25 :)

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Discord Channel - open channel available to all.