Daily

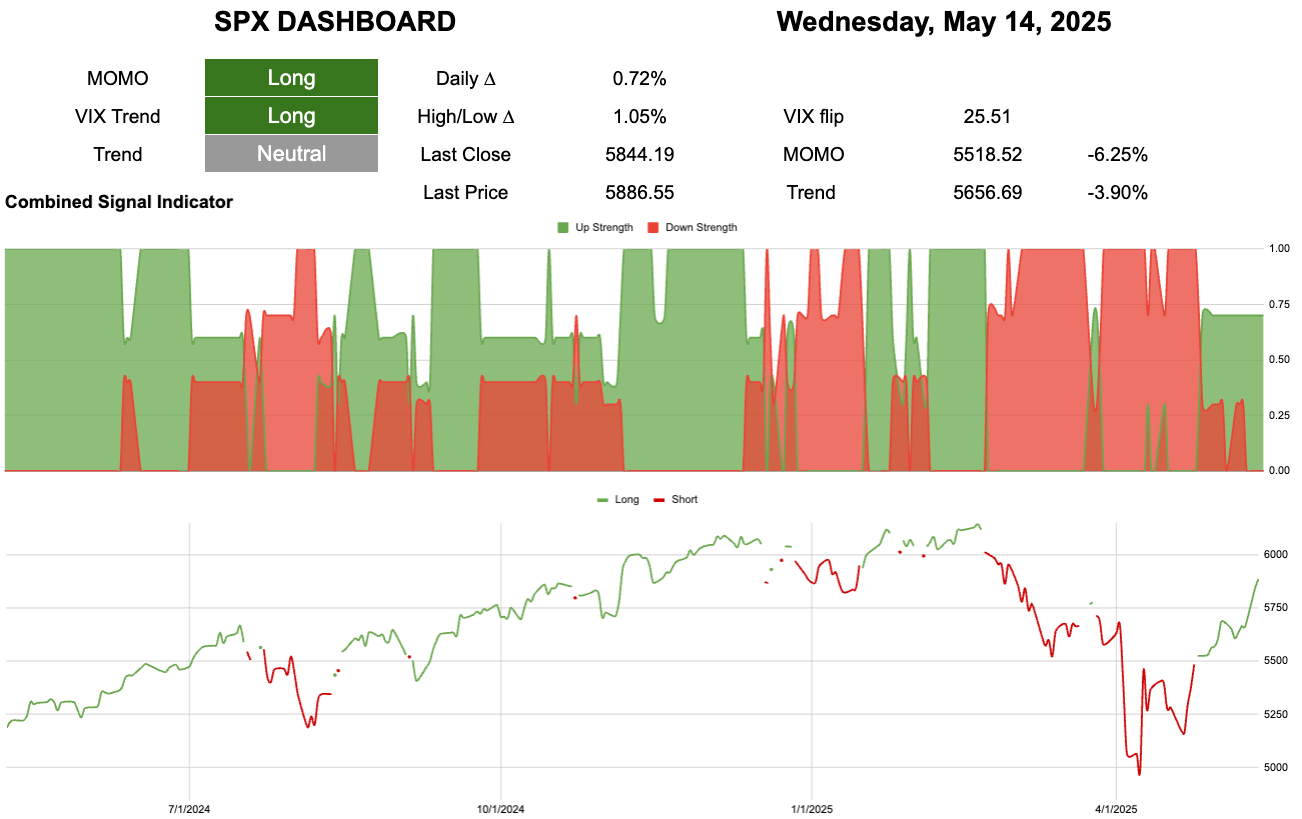

Big game we have potentially just started a strength of signal move.

Again we finally have the pair together. Momentum triggers on the back of “stinky fingers” oversold measures.

But using this daily we have reached this red line decision point. I have discussed since this sell off took hold.

Will this be March 2022 or November 2023?

Who knows?

Hourly

When we drop down to hourly charting this move has come and the strength of signal measures are all very high.

When we look at the volatility bands they have compressed, meaning a break of these is potentially easier to happen. Just like the daily charts though a “black line of doom” move today would be -4% unlike 2-3 weeks ago it would have been -15%.

We need to take these in perspective.

I am not telling people to go short sell everything.

We are heading into OpEx, CPI and VIXperation blah blah. More important to me is those things are happening at a decision point. So we don’t need to be a hero.

If you use this substack just for the above chart then you are long and happy.

There could be short term weakness or simply short term nothingness because the new longer trend matters more.

Let’s watch and see.