Did the market telegraph its punches...?

Thursday 18th January - Daily Equity Update

Hump day is out of the way I have updated the above charts to represent yesterday’s close.

Buy Strength, Sell Weakness - Discord

I intend to create some videos that better explain what and how I measure the things I use to calculate all the various signals. There is always a balance to be made between the simple and the complex so I don’t want to just firehose everything. The plan was just to hit record and see what came out, but I will just sit on my hands for the moment.

Please use the link above to post any questions that you want answered.

This will not turn into some daily trading signals or update forums but hopefully, a place to share information or questions. If we get some good questions we can use the video section to do a live chat where I can hopefully make things clearer in real time.

Two red lights on the board at the index level. VIX spot is above its flip line of 12.93 and the price just squeaked below the momentum line after a rally into the close. As of writing which is 11 am London (6 am NY time) pre-market pricing has us above this level. Which will bode well perhaps for all the positions I am about to close.

Over the last week or so we have seen just only in this portfolio but the entire SP500 an arrow to the knee for names that by this system are a “long”. This means above momentum and trend. Uptrend is taken from those daily scores over different timeframes to calculate a signal strength score. We then look and see if that is rising or falling, which gives us the “Uptrend”.

The clear stand out is Staples and to a lesser degree Health Care.

I normally list reductions but it might be easier to list what we are keeping...The positions we are closing are listed below. These prices will be updated better or worse to reflect opening prices later today.

We have many positions reduced to cash even though only two have fallen below momentum and trend. This comes from the “uptrend” calculation. Regardless of its price today its signal strength is weakening therefore I do not want to ride a trade down.

As with any system sometimes you win sometimes you lose. Sometimes you want the look back to be longer or shorter, “if only” we had done this or that.

It all comes out in the wash.

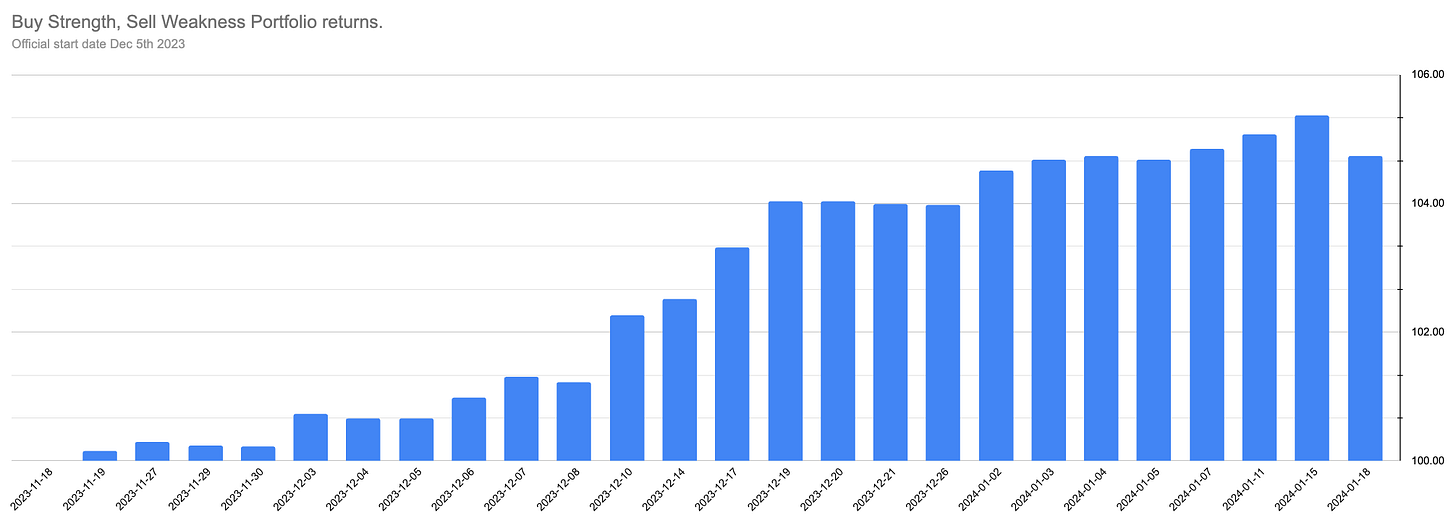

The biggest down day since I started this Substack. My $100 is now only worth $105.

I only count closed trades and we have some whoppers in the basket..