Dems be da rulez..

Friday 24th May - Daily Equity Update

Did everyone survive the 74bps “CRASH” yesterday?

Power outages? Tornados in winter? Cats living with Dogs? Fire on YouTube thumbnails?

I never fully answered a question I posed to everyone last week about index moves.

I posed the question about an index of two stocks.

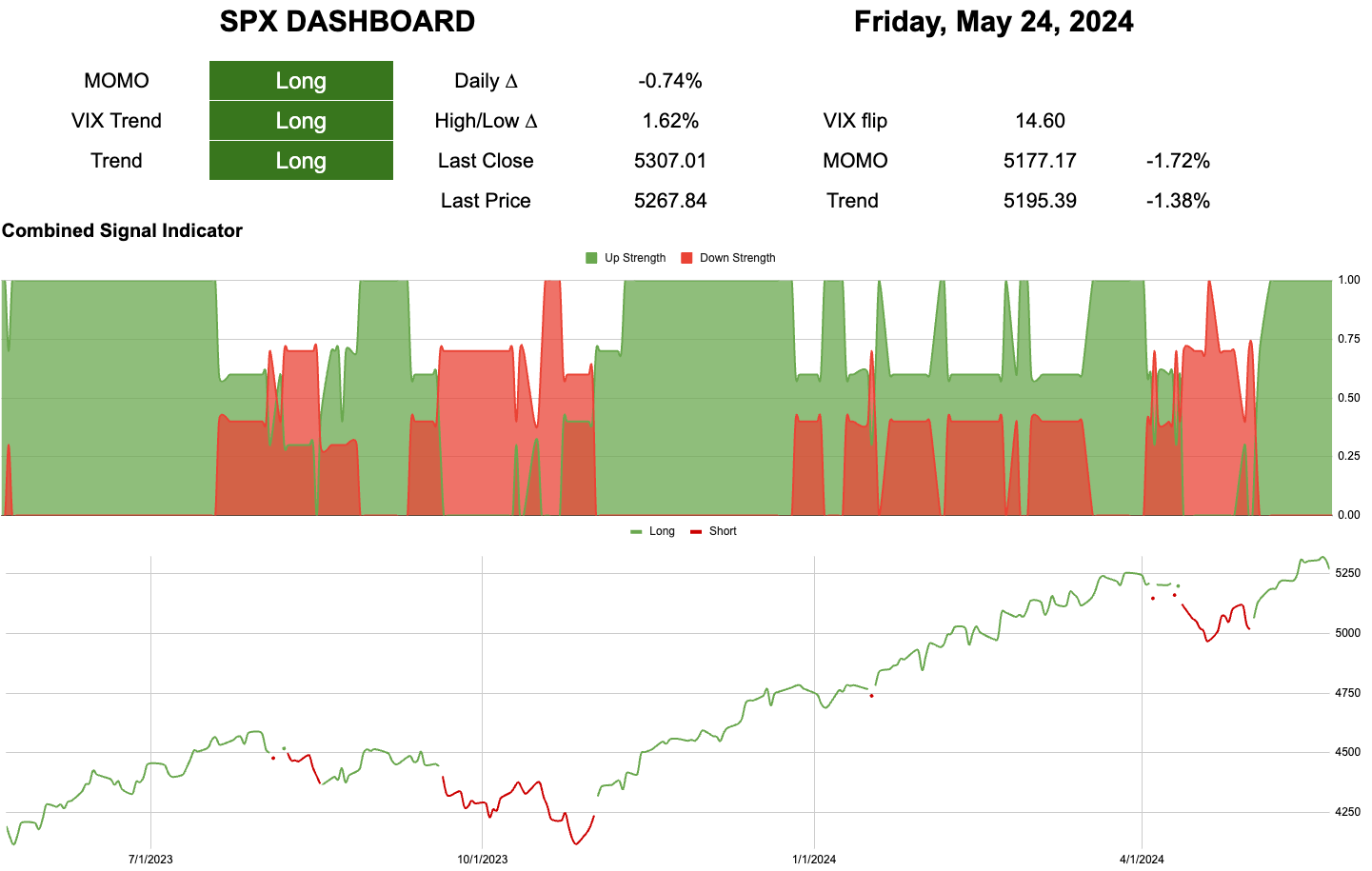

Let’s look at it again here yesterday using Tier1Alphas new dashboard.

If a stock moves 940bps which makes up 40% of the total market move due to its size.

But because the index is the largest single market for trading/hedges/derivatives and only moves 74bps what must happen to all the other components of the index? Will they just sit fat dumb and happy?

Think of it like a car crash. You along with the car are moving at 50mph and you hit another object. The car begins to slow because of the impact but you are not connected to the car and you continue to move at 50mph. Modern safety measures like seatbelts airbags etc will trigger but you get my point. In this analogy its the car the SP500 that has all the safety measures which triggered to stop it from moving. This meant the passengers were free to move.

This highlights a systematic/discretionary dilemma which I will go into on the other side of this wall.

Behind this fog of war, I construct a portfolio of the 50 stocks in the SP500 with high and rising signal strength. Free of any priors or bias I don’t care if Twitter says we are going into recession and my system is piling into high beta growth stocks. I have a system to get us out if we are wrong. It’s a game of percentages. It’s boring and often there is nothing to write about, but it beats trying to trade using stories that we tell each other.