Corrections can Happen in Price or Time

Sideways.

Just keep swimming 🐠

Hourly

Depending on your active timeframe, I guess this could be called “indigestion.” What most people will think is that we need a pullback in price before the next move higher.

If you look back at the top chart from January, we had a very strong up-move after Halloween. Then, through December into January OpEx, we saw sideways price action. In terms of volatility and momentum, that price action over time had the same effect on the underlying numbers as a short, sharp move lower in price.

Everyone was expecting a move lower, but we got the opposite.

I am busy building today after a very productive and thought-provoking dog walk at 6 a.m. this morning. Thank you, Hank.

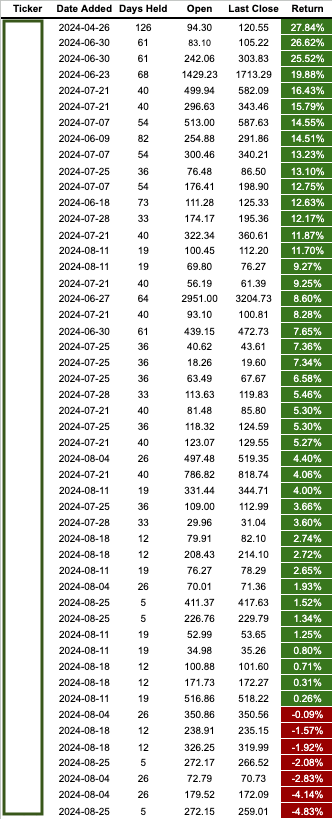

Performance:

Current closed equity return = 20.8%

Current open equity return = 28.9%

If all current positions close at stops, our return = 23.4%