Bring Back Boring Markets!

Week 15 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

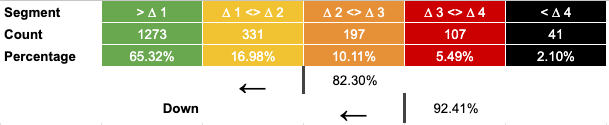

Very close to regaining momentum, but trend still eludes us.

This is where new and old prices are important. Prices going up and old prices leaving the lookback all matter for calculations as we move forward.

Daily:

I have added this chart to show why the trend levels are important.

Everyone wants to be the guy posting amazing day trades in the black and red zones of +/- 5-10% days. I am boring. I much prefer the vanilla +/- 0.25-1% days in the green zone.

Why?

There are 150 Red/Black days and 1500 Green/Yellow days. Riding those trends are long and boring. I love it!

What is also very important and I hit on this in Hot Takes with Hank SVB, MoF or Tarriffageddon strangely never happen in the green zone.

They always happen as we have already started a transition into Yello/Orange/Red. Weird!

Almost like “no one saw it coming” is all a nonsense.

Current Open Equity = 27%

Stop Loss Trigger = 26.7%

Current Closed Equity Return = 26.9%

Our open equity outstanding is ~27% since we started in Dec ‘23. We have been able to capture ~27% returns in closed trades, meaning ~0% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Discord Channel - open channel available to all.

https://discord.gg/vsdBws3Rmg