Bear Market Bounce?

Week 11 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

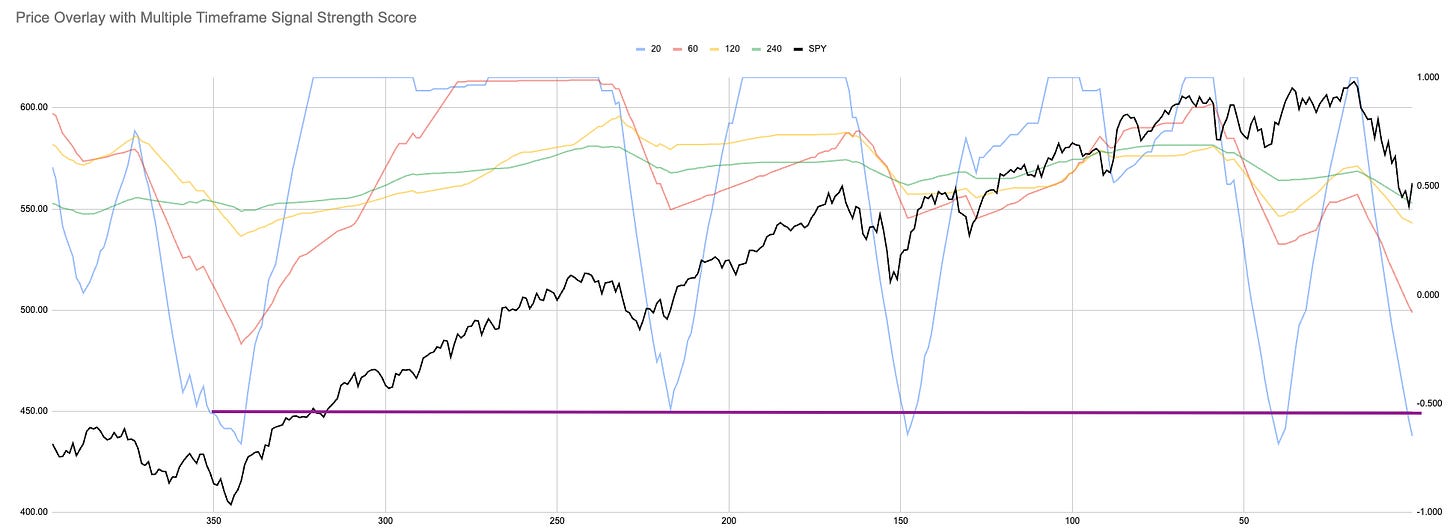

We remain below momentum and trend, which means we remain in the red.

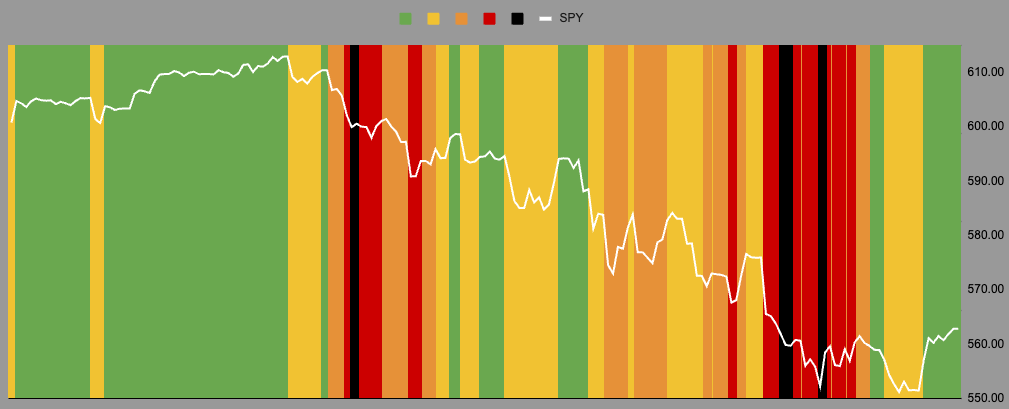

The red denotes large swings, both up and down.

Daily timeframe:

Interesting point? Or is the longer timeframe Strength of Signal falling more important now?

Hourly timeframe:

In the hourlies we could see a bounce. Does that mean weeks, days or hours?

Others:

Seasonality season. Are we off to the races in time for spring?

Current Open Equity = 30.9%

Stop Loss Trigger = 29.3%

Current Closed Equity Return = 29.1%

Our open equity outstanding is ~31% since we started in Dec ‘23. We have been able to capture ~29% returns in closed trades, meaning ~2% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit bar any gap risk we hope to close ~29%

It cannot always be rosy! There is no free lunch we have to risk losing to be in the game to win. We could have a +0.2% addition on closed equity.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

And our current open positions:

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Discord Channel - open channel available to all.