Assets Are a Means to an End, Not the End

Wednesday 13th November - Daily Update

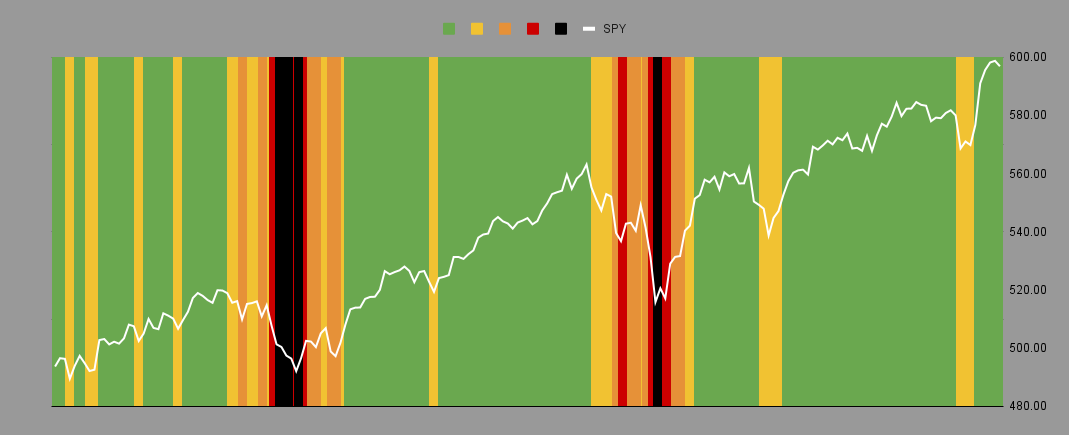

With the range from 5865 to 5901, we find ourselves in an awkward position where the trend is above momentum. This means we’re missing the “early warning” we’d usually rely on. That’s why having multiple metrics keeps us on track.

Trend is a moving target, but it’s still better than having no target at all—or, even worse, trying to aim at a target without knowing its accuracy.

Everyone focuses on being right, but for me, what matters more is understanding how often my system is wrong.

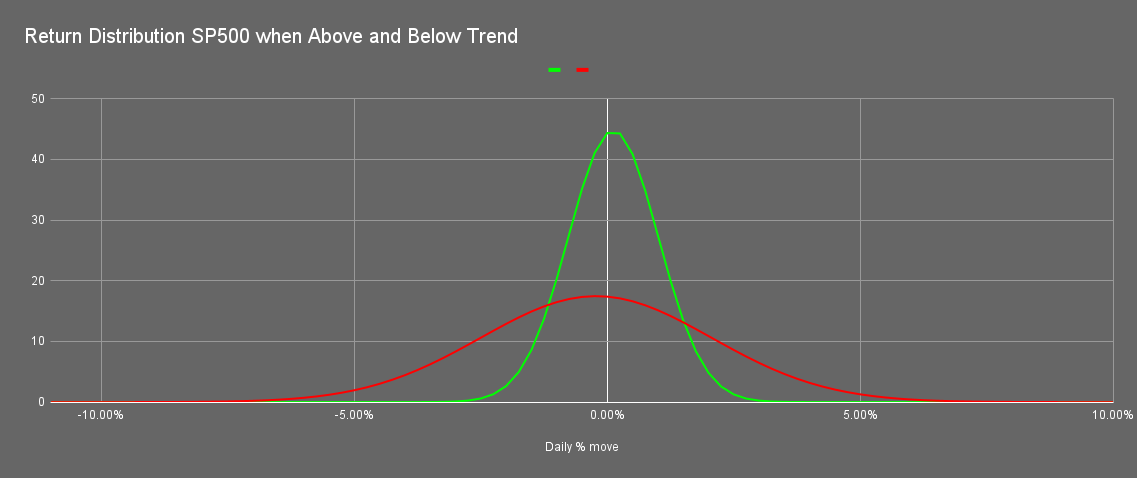

Maybe “wrong” isn’t the perfect descriptor, but I know when it hurts. When we’re above trend, I can live with the +/- outcomes of the green distribution, but I can’t accept the red. So, that’s my cutoff.

When an asset is above trend, I can go long, depending on how it ranks against everything else. When it’s below trend, it may as well not exist. The system doesn’t even show it to me anymore because of the above chart.

There’s no need for stories or rationales about why something is “changing the world.”

Crypto is very clearly above trend. I made a post about Ethereum at the end of September.

My goal with this Substack was always to help people make money in the good times and, hopefully, save money in the bad, so we can all go live life. There’s more to life than finance. Getting attached to some asset or coin until it defines you honestly freaks me out.

Finance is no different than your local corner shop owner noticing a trend in a particular sweet, candy, or drink, buying stock from wholesalers, and selling it at a margin for profit.

That’s what I do.

I couldn’t care less about what the stock, ETF, coin, or bond is. It’s just a ticker with numbers that tell me whether I should hold it or not.

We’re not there yet, but there will soon come a time when you’ll have to sell something that might have made you very wealthy.

Don’t let something define you because it’s up 500%. When it’s down 20-50-90% on the other side, you’ll be fighting not to be defined by it then.

This all feels very 2017-ish. Go make money but don’t fall in love with it.

I use this kind of analysis on all 500 tickers in the SP500 to construct a portfolio.

You can see more in this week’s weekend rundown and portfolio update here.

Current Open Equity = 36.2%

Stop Loss Trigger = 28.7%

Current Closed Equity Return = 26%

Our open equity outstanding is 36% since we started in Dec ‘23. We have been able to capture 26% returns in closed trades, meaning ~10% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit today bar any gap risk we hope to close ~28.7%

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

https://discord.gg/mRqaghXV ← New subscribers make sure to join Discord using this link. If you are a new paid subscriber send me a DM to gain access to the subscriber section.