Are you not entertained?

Does it sometimes feel like, just for a minute, people think Mr. Powell is going to solve world hunger or reverse climate change?

Only for everyone to come to work the next day and realize we just have to do the same old stuff we always do, or else nothing will get done.

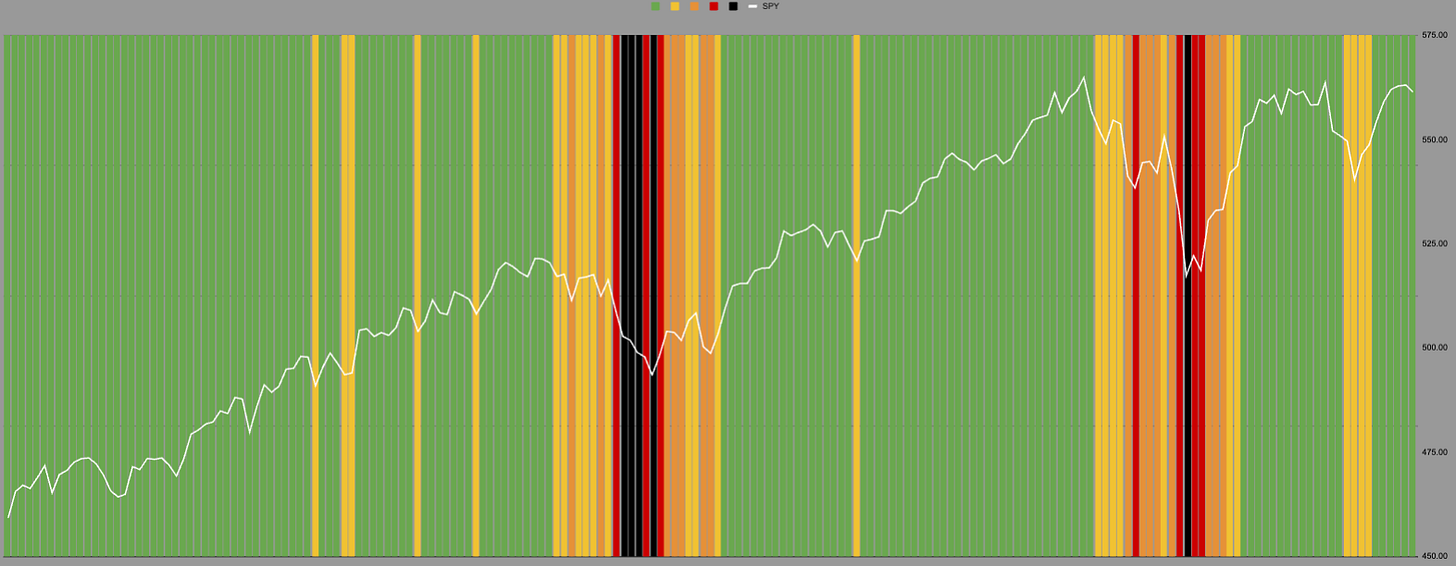

Anyway, the markets have moved, and 5548 and 5525 are still the lines in the sand.

Subscribers can find the links below. Since it's hump day, I’ve updated all the SP500 data that feeds into portfolio construction.

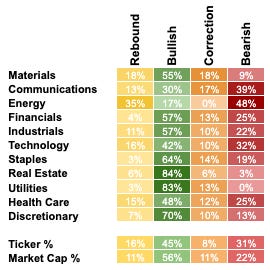

This chart shows what percentage of each sector within the SP500 is bullish, bearish, or somewhere in between:

Bullish = ST and LT momentum are rising

Correction = ST falling, LT rising

Bearish = ST and LT falling

Rebound = ST rising, LT falling

Currently, there are 304 potential longs to choose from at the next rerank.

That’s what I have to look forward to on Sunday, so I don’t have time to worry about whatever nonsense Mr. Powell is saying :)

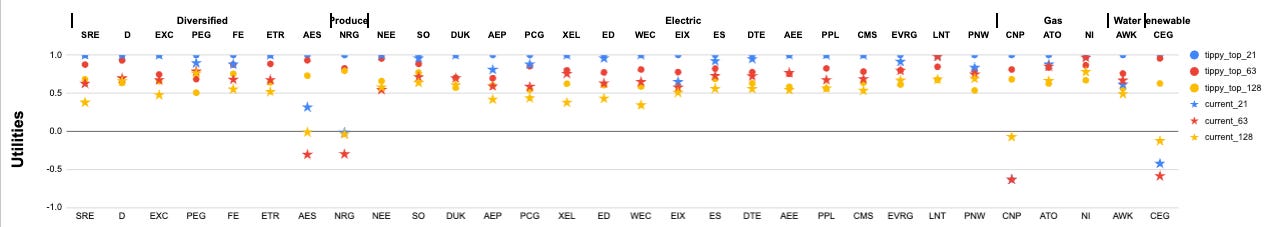

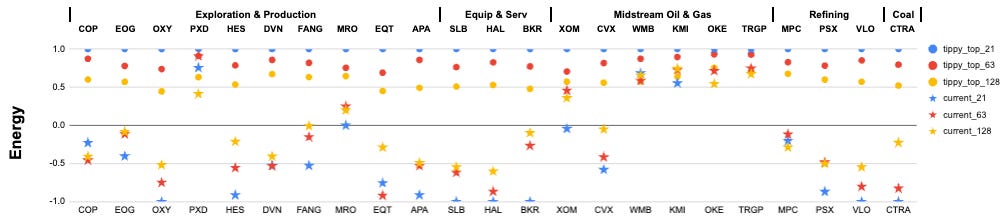

These charts are messy, but I use them a lot. I can look at one page and see all 500 tickers in a flash. It doesn’t necessarily offer deep insight, but it highlights what’s standing out.

What they show is the current Strength of Signal score across three different timeframes, compared to where these measures have topped out in the past.

Energy is the only out-of-sync sector, just as it was in February. And we all know how that turned out in May. Utilities followed a similar pattern a couple of months later. Materials might now be unwinding its non-conformist phase, which means we should start looking at energy again.

ALB and DOW look interesting. ST momentum needs to catch up before MT or LT can. You can see the blue stars on ALB, standing out above the others.

When we combine this with an all-green index in the opening chart I post every morning… who knows?

Everyone says you need to be first. I’m not sure I agree. I’ve learned that momentum pushes much further than you’d expect in this market.

Let’s see how it goes, one step at a time.