Aaaaargh Panic! Or...?

Wednesday 20th November - Daily Update

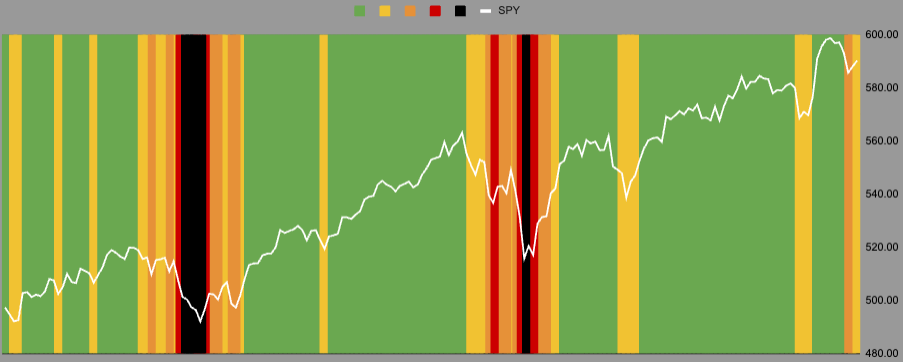

5866 - 5901 is the line in the sand.

If you haven’t read our post highlighting the changes to the substack moving forward, please do that now.

Daily

Hourly

Aaaarrrgh panic!

Or did the internal wiggles just move from for want of a better term “overbought” to “oversold”?

I use this kind of analysis on all 500 tickers in the SP500 to construct a portfolio.

You can see more in this week’s weekend rundown and portfolio update here.

Current Open Equity = 34.8%

Stop Loss Trigger = 27.9%

Current Closed Equity Return = 25.2%

Our open equity outstanding is just shy of 35% since we started in Dec ‘23. We have been able to capture 25% returns in closed trades, meaning ~10% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit today bar any gap risk we hope to close ~28%

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

https://discord.gg/6naRC4Nx ← New subscribers make sure to join Discord using this link. If you are a new paid subscriber send me a DM to gain access to the subscriber section.